The 21st Century Global Economy

22 Jan 2020|Linda Yueh CBE FREcon

- Research

The world changed dramatically in the latter part of the 20th century. The conclusion of the Cold War at the end of the 1980s heralded a period of not only profound political but also economic change. The United States emerged as the sole superpower, in political and economic terms. Its currency, the U.S. dollar, is the de facto global reserve currency in which international investments, commodities and energy are priced. Its debt was demanded around the world as safe investments whilst it remained the innovation leader.

But, at the same time, other fundamental structural shifts were occurring, notably the rise of emerging economies such as China. China catapulted itself in a mere three decades or so into the world’s second largest economy from one of its poorest in 1980. The speed and size of Chinese growth makes it a key factor in the shift in global economic weight in the 21st century.

Since then, the U.S. and China have been the “twin engines” of economic growth. Then, after the global financial crisis of a decade ago, growth in the world economy of the 21st century now derives more from emerging economies than advanced economies, heralding the end of the American economic hegemony and the rise of a dual or multi-polar world.

The global re-integration of emerging economies in the early 1990s by embracing opening and marketisation has fundamentally changed the structure of the world economy. These changes coincided with significant institutional changes in the advanced economies, including financial de-regulation that fostered the rapid development of global capital markets as well as a period of fast growth in not just international trade but also of offshoring to take advantage of the new sources of cheap labour in the developing world. Technology also fuelled further shifts in global supply chains and e-commerce across national borders.

One potential consequence is that the structure of the 21st century world economy might become dominated by “giants.” Global growth could increasingly be driven by “giant” economies with large populations (China, India, the United States) as well as by economic entities with sizeable markets, such as the euro zone or the ASEAN Economic Community (AEC), which is the 10 countries of the Association of Southeast Asian Nations’ (ASEAN) equivalent to the European Union single market. The African Union and various groupings in Latin America are also pointing to the trend of joining markets together to help domestic firms gain economies of scale. That would help them compete with the biggest companies in the world, many of which are based in “giant” economies and economic blocs.

If this multi-polar world grows well, then the global economy might enjoy another golden age. The first golden age of economic growth was during the 1950s and 1960s when average incomes grew strongly during a time of peace, powered by the opening of US markets.

China’s population is much larger than the US when America was the main engine for the strong growth of the golden age. With emerging economies like China, India, southeast Asia also acting as engines, world growth will likely be faster than when it was mainly driven by advanced economies. It’s because emerging economies are in the industrialising or catch-up phase, so they tend grow at higher rates than advanced economies. But it also means that they are more volatile and have less stable growth trajectories.

And growth centred in such “giant” economic blocs also poses challenges for other countries. Countries would additionally need to consider their growth strategies in order to compete and engage with “giant” economies which have populations in excess of a hundred million people. This is already seen in the proliferation of regional trade agreements that seek to link markets together, most recently the CPTPP, which is a free trade agreement among 11 Asian economies which do not include the giants, i.e., the United States and China.

Since the 21st century could witness another “golden age” of prosperity driven by economies which possess large numbers of middle class consumers, the challenge for less populous countries would need to centre on how to compete, and also integrate, in a global system with multiple poles of growth. But by fashioning trade agreements and other forms of global integration, it does also mean that smaller countries could potentially link their economies to not one but several economic blocs to their benefit. Politics permitting of course.

In short, the 21st century global economy looks rather different to the 20th century. A new potential “golden age” could emerge if billions of new middle class consumers from emerging economies rejuvenated the world economy and ushered in another era of prosperity. How economies such as China and other sizeable markets are developing and reforming will be important to better understand how the structure of the world has changed. It’s an exercise that all nations should undertake.

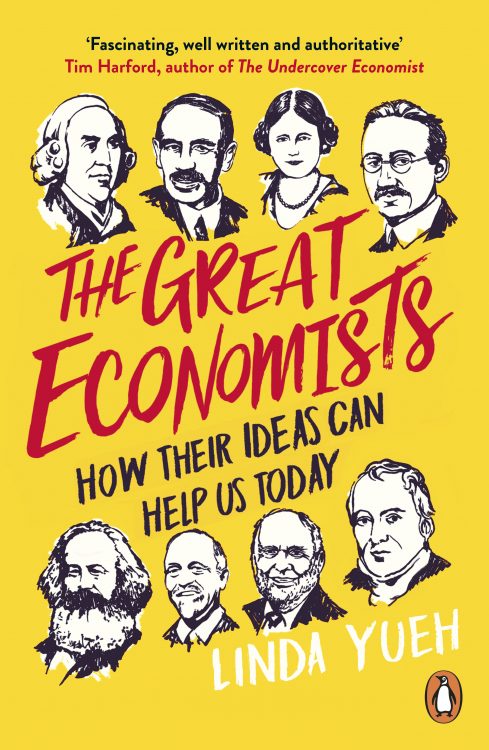

For more on the new global middle class, see Linda Yueh’s book, The Great Economists: How Their Ideas Can Help Us Today.

Category: Research

Author

Linda

Yueh CBE FREcon

Linda Yueh is a Fellow by Special Election in Economics and author of several books including The Great Economists: How Their Ideas Can Help Us Today.