This Time is Different: Economic Policy Challenges in the Time of COVID-19

9 Jun 2020|Dimitrios Tsomocos

- Research

A famous economist, the late Rudi Dornbusch proclaimed in an interview with PBS in the US in April 8, 1997 amidst the Mexican Crisis, that “The crisis takes a much longer time coming than you think, and then it happens much faster than you would have thought.”

During the unfolding crisis, I have been following the economic consequences that are rapidly evolving.

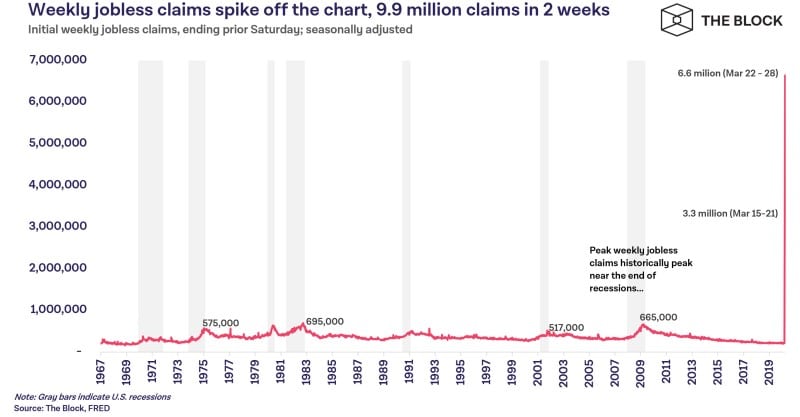

I participated in a webinar organized by the International College of Economics and Finance and the Higher School of Economics in Moscow, on the economic consequences of the pandemic. Unemployment shot up fast in the US, see figure 1, and elsewhere in the world.

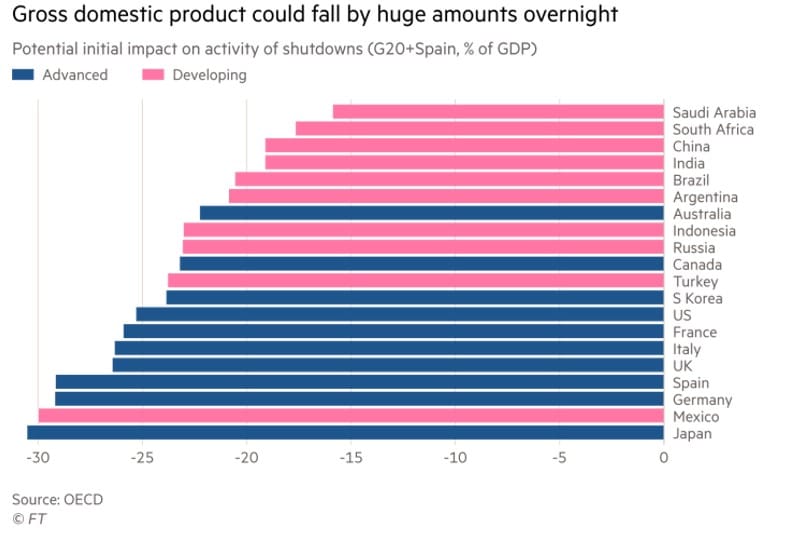

Moreover, the expected impact on the Gross Domestic Output may be dramatic, as can be seen in Figure 2.

The COVID-19 pandemic prompted governments and central banks around the world to inject liquidity via bank credit into the economy and initiate robust fiscal stimuli as the recent European Union proposal in late May. On 17 March, the UK government unveiled the first financial stimulus package totalling 15% of UK GDP in state-backed loans for all businesses through the banking system with the help of the Bank of England. Across the world, money-financed stimulus measures have been adopted in Japan, the US and the Eurozone, and supervisors across Europe have relaxed banks capital requirements to increase liquidity in the economy so as to avert a potential credit crunch that may precipitate in extensive default and a deep recession. Notably, in April, the UK became the first country to allow the central bank to directly finance government spending!

I argued, as in my ongoing research, “Support for Small Business,” jointly with Charles Goodhart, a renowned British economist and Xuan Wang, a D.Phil. student of mine to investigate measures that will keep as many small and medium sized companies in current operation as possible. But this will involve the rescue and support for companies of low profitability and productivity, sometimes described as “zombie companies”. They may then remain in existence for a long time, leading to misallocation of resources and, therefore, inefficient investments. We assess the optimal policy response and appropriate regulation in an artificial context in which stabilisation problems are assumed away. We extend the analysis to a more realistic situation, in which stabilisation problems remain. We discuss the trade-off between economic stabilisation and resource allocation, dissecting the various forms in which stabilisation policies increase employment and welfare.

Moreover, in a seminar I gave at the Saϊd Business School on, “Financial Stability and Macroprudential Policy in Emerging Economies: an Application to Chile,” based on joint work with Juan Martinez and Udara Peiris, both of them former D.Phil. students and nowadays the former, a senior economist at the Central Bank of Chile, and the latter an Associate Professor of Finance. I argued about the effect of macroprudential and regulatory policy in dampening the effect of shocks, as the recent supply driven COVID-19, to an economy estimated to Chilean data.

My results suggest clearly that the diverse impact of shocks, like the one generated by COVID-19, on large and small banks implies that Countercyclical capital buffers (i.e., regulation that leans against the wind) should be introduced together with countercyclical Liquidity coverage ratios (i.e., regulation consisting of complementary measures that lean against the wind). This is because the countercyclical LCR combined with the CCyB makes it costly for banks to expand their balance sheets. Hence, it helps to dampen fluctuations in leverage over the business cycle and, therefore, minimize the probability of a financial crisis. As we can vividly see in Figures 3 and 4, Gross National Product, Consumption and most importantly default variation is reduced when the optimal regulatory policy is adopted. Indeed, we observe in Figure 3 that the baseline GDP and Consumption vary more than when we implement the afore- mentioned macroprudential policies. The same applies for the percentage change of loan loss given default in Figure 4. The upshot of the analysis is that as many negative economic and financial repercussions permeate society during a crisis so many policy responses are warranted. Policy makers cannot kill two birds with one stone!

References:

Andreev, Mikhail, M. Udara Peiris, Alexander Shirobokov and Dimitrios P. Tsomocos, “ Commodity Cycles and Financial Instability in Emerging Economies,” Working Paper Series, No. 57/May 2020, Bank of Russia, 2020.

Goodhart, Charles A.E., Dimitrios P. Tsomocos and Xuan Wang, “Support for Small Business,” mimeographed, 2020.

Martinez, J.-F., M. Udara Peiris and Dimitrios P. Tsomocos, “Financial Stability and Macroprudential Policy in Emerging Economies: an Application to Chile,” Bank of Chile Working Paper, forthcoming, 2020.

Category: Research

Author

Dimitrios

Tsomocos

Dimitrios P. Tsomocos is a University Professor of Financial Economics and Fellow in Management at St Edmund Hall.