What we can learn from the Great Economists

20 Feb 2019|Linda Yueh CBE FREcon

- Research

Linda Yueh is a Fellow by Special Election in Economics and author of The Great Economists: How Their Ideas Can Help Us Today.

Mark Twain reportedly observed: History doesn’t repeat itself but it often rhymes.

That was one of the reasons why I turned to the lessons from history to glean how best to analyse and help solve our current economic challenges.

In the past few years, we have experienced the aftermath of the worst systemic banking crisis since the 1930s Great Depression. To not repeat the worst consequences of that economic crash required learning from history. For instance, by ensuring that monetary policy was supportive, policymakers avoided deflation, which are price declines, as well as a second recession which had occurred in 1937.

Indeed, one of my chapters, which is based on the work of the great American economist Irving Fisher, is entitled: Are we at risk of repeating the 1930s?

I should add that he’s not normally included in books such as this one because he predicted in 1929 that the stock market was at a permanently high plateau. He then forecast a robust recovery throughout the 1930s. It destroyed his reputation and his personal fortune. But, his ideas, especially debt-deflation, were instrumental in helping policymakers avoid the worst of the aftermath of the 2008 financial crisis.

Another issue that I cover is: Do we face a slow growth future?

Because of how slow economic growth has been since the 2009 Great Recession and slowing productivity growth even before then, economists have been talking about ‘secular stagnation’ in advanced economies. This was a term, though, first heard in the 1930s when economists were worried about stagnation due to an ageing population.

After the golden age of growth in the 1950s and 1960s where per capita or average incomes grew strongly, it wasn’t much of a concern at least until now.

So in that chapter, I look at the work of Robert Solow, the creator of neoclassical growth models, to examine the Solow Paradox. This refers to his observation that you can see the computer age everywhere except in the productivity data.

There’s even a Bank of England study that found that as smartphone penetration increases, productivity goes in the other direction!

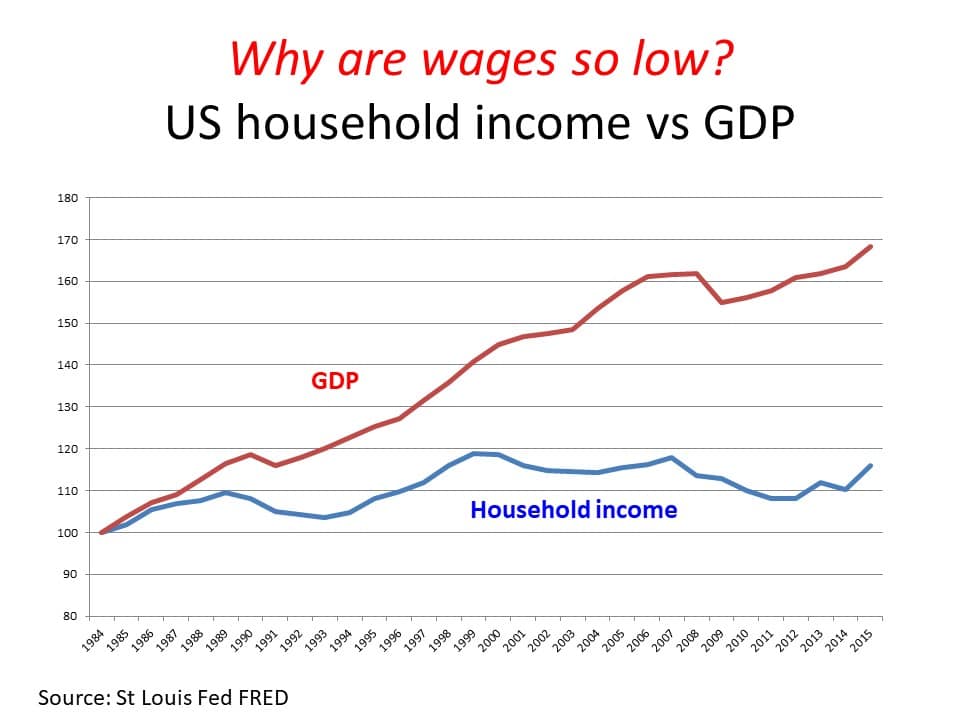

That’s not the only area where we can learn from history. The word “unemployment” first appeared in the dictionary after the Long Depression or Great Depression of the 19th century. That and the Great Depression of the 1930s led to work by the great economist Joan Robinson who proposed the concept of ‘disguised’ or ‘hidden’ unemployment to capture those who wanted a full-time job but could only get a part-time one. Fast forward to today and the increase in temporary workers and other forms of disguised unemployed are both challenging issues once again. The chapter that uses her ideas is entitled: Why are wages so low?

Robinson’s concept of monopsony, which is when employers have monopoly power in labour markets, is one of the explanations economists are looking at to help explain why wage growth has lagged behind even as the economy is doing better. For instance, at the annual Jackson Hole gathering of central bankers and economists, monopsony was avidly discussed.

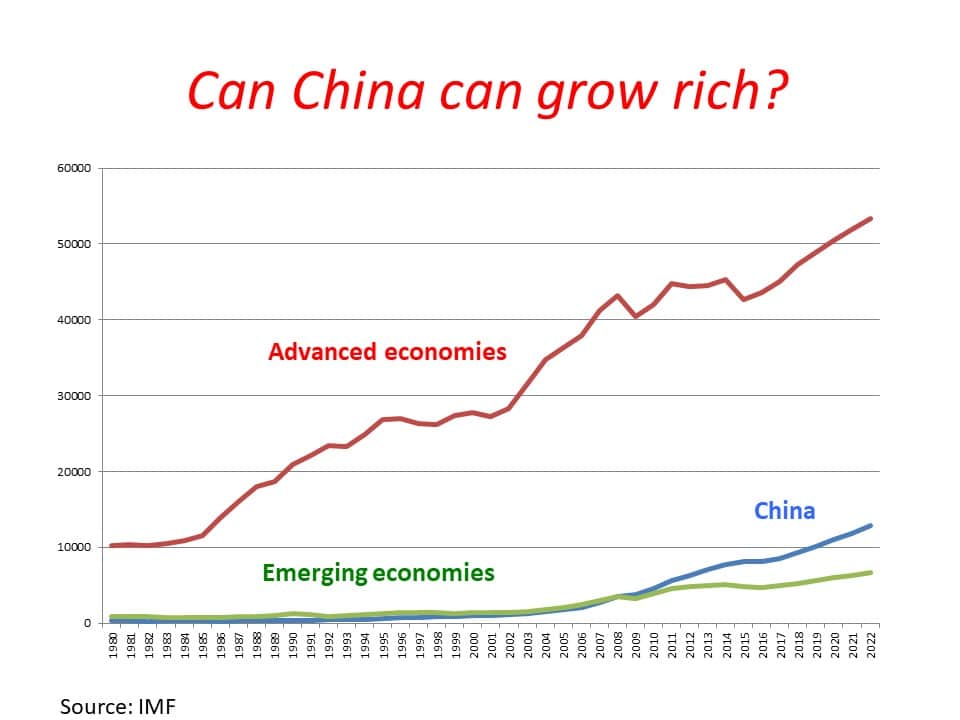

Finally, drawing on several books on the Chinese economy that I have written, one of the chapters asks: Can China grow rich?

To understand China requires a familiarity with its history and economic policies, especially since market-oriented reforms began in 1979. It is thus natural to look at how China has fared historically in order to assess where it currently stands and where it is headed. That chapter discusses Karl Marx whose communist ideology still affects the principles underpinning some of the Chinese system.

In all of the chapters, in order to understand the ideas of the great economists, I delved into their lives and the times in which they lived. So, each chapter includes a potted history of very influential economic thinkers that have transformed our world over the past 250 years.

Writing about what made them so successful and influential was one of the most enjoyable parts of crafting the book.

One conclusion that I came to was that the greatest economists were hard on themselves and always thought that they could do better. Adam Smith, the father of economics, was so disappointed with his output that he wanted his remaining manuscripts burned after his death!

Thankfully his work survived and has formed the foundation of modern economics.

Read more on our blog

Category: Research

Author

Linda

Yueh CBE FREcon

Linda Yueh is a Fellow by Special Election in Economics and author of several books including The Great Economists: How Their Ideas Can Help Us Today.